Financial mathematics is a specialism vital to the day-to-day functioning of the world’s economic institutions. Technical and theoretical aspects of mathematics are applied practically in this fascinating discipline, which involves predicting the behaviour of markets, suggesting strategies for investment and managing risk.

Details about the course including costs, assessment, and descriptions of modules can be found here: www.mdx.ac.uk/courses/postgraduate/financial-mathematics

CISI Partnership

We’ve partnered with the Chartered Institute for Securities and Investment (CISI), a leading financial sector professional body, to ensure you will develop a professional overview of the financial sector as well as advanced quantitative skills.

Press

Benefits

- The CISI professional qualification Introduction to Investment is part of the teaching and assessment of our module MSO4114 Financial data and professional practice – you will graduate with this qualification as well as the MSc/PGDip Financial Mathematics!

- On graduation you will be entitled to become an Affiliate of the CISI to access further networking and professional development opportunities in the financial sector.

- Throughout the course you will gain access to academic and professional talks, training and networking events on campus and in the financial heart of London. In the optional module MSO4117 Current topics in financial mathematics you can write about these talks for credit towards your MSc/PGDip.

- You can take part in the CISI Educational Trust Awards – one student on the MSc/PGDip Financial Mathematics course will win £500 for an excellent piece of coursework and be invited to a further national competition.

Alumnus testimonial

“The MSc in Financial Mathematics developed my creativity and analytical thinking to evalaute situations. It provided me with the tools to enter in an Asset Management firm as a Research Analyst.

If find my current role really interesting and challenging. I have to seek information from over 15 countries and their different ways of doing business to provide advice on the investment pipeline projects of the Fund.

The CISI offers home and international students a well-known certification in finance which provides access to multiple areas of specialisation in the future. It opens new opportunities for employment and students have access to a network of professionals.”

Course structure

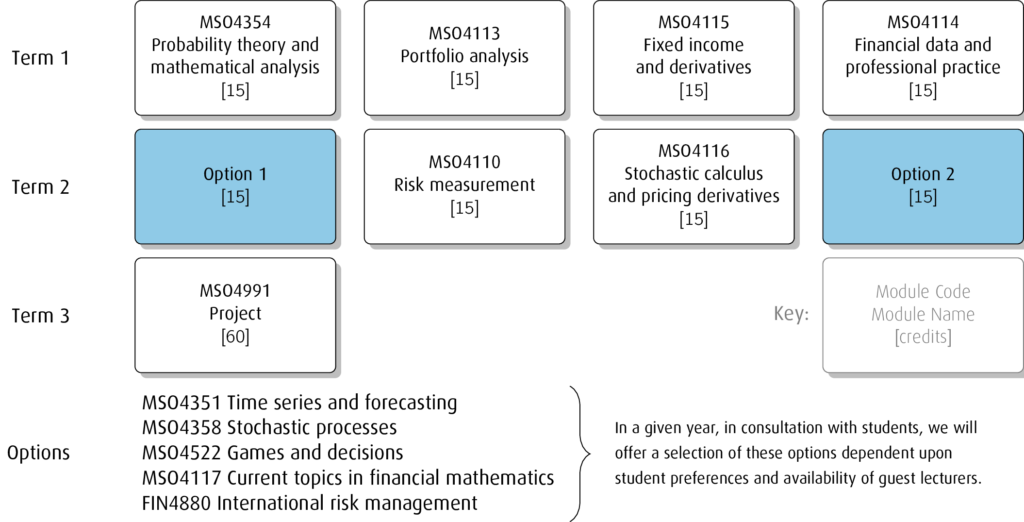

Full time

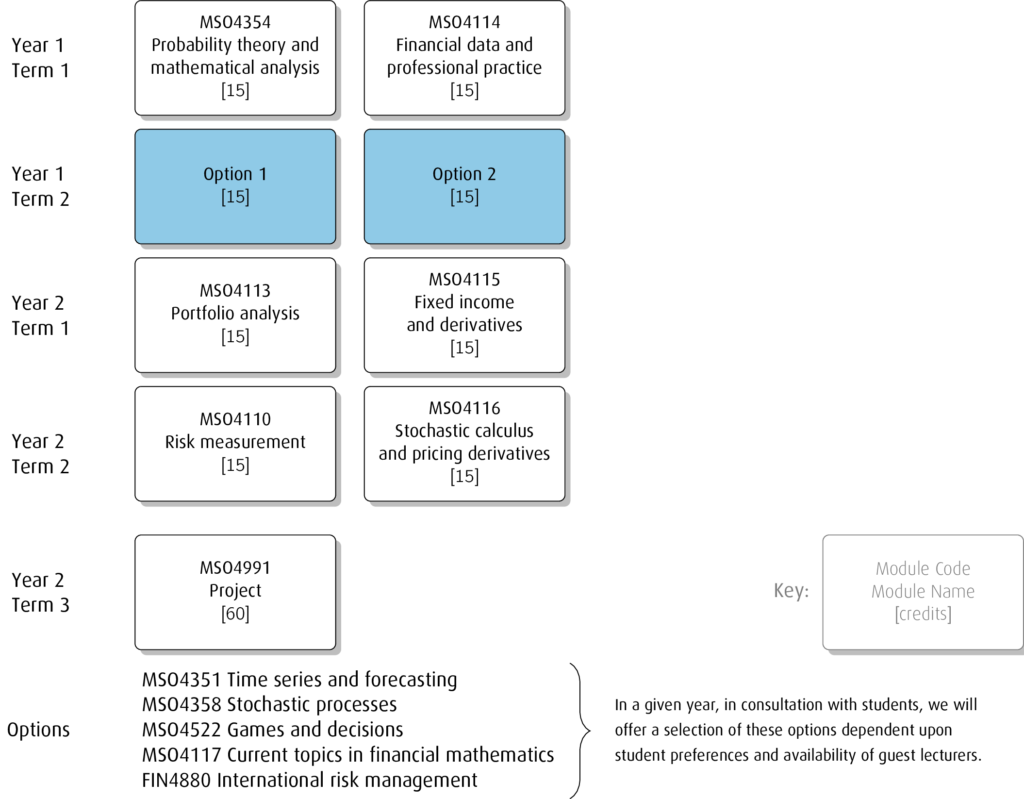

Part time

Teaching

We often use programming languages like R to do probability calculations and simulate financial models.

In a lab session we could simulate Geometric Brownian Motion – a standard model for share prices:

Code available here: https://github.com/nicholassharples/GBMRealisation

These simulations help us develop some intuition about what these models are doing:

The graph shows 50 realisations of the same model. If we use this to model share prices we must accept that any of these could be the result (with vastly different financial outcomes!)

We’ve now simulated these objects and developed some intuition. Let’s turn to the mathematical theory and explore their important properties. Here’s a (sped-up!) lecture from 2020-21 about the reflection principle. We record all of our lectures (whether on-campus or remote).

After the lecture we share the digitally annotated slides for easy review – this makes it much easier to join in the converstation in the lecture, rather than just taking notes! The slides for the above lecture are here: